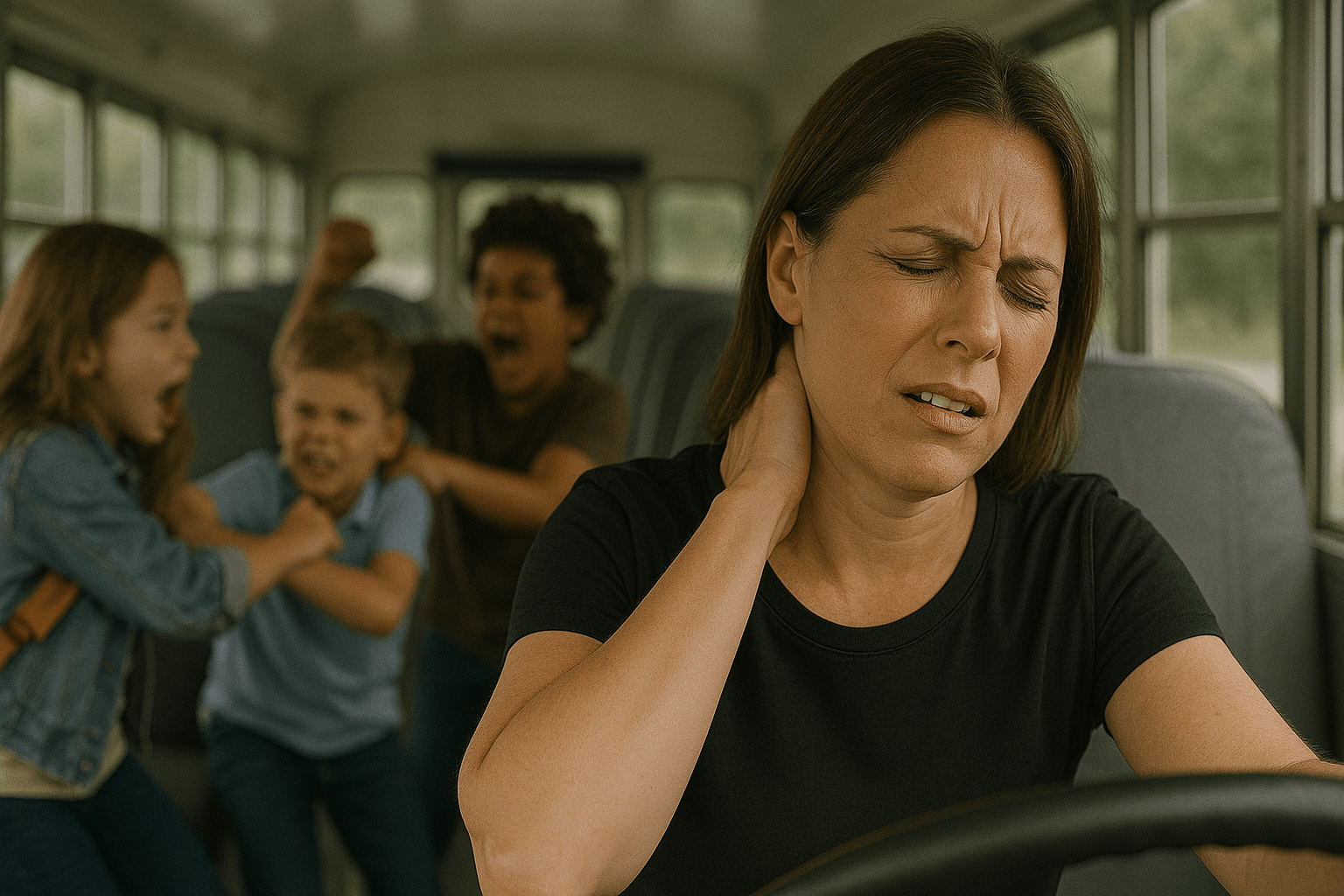

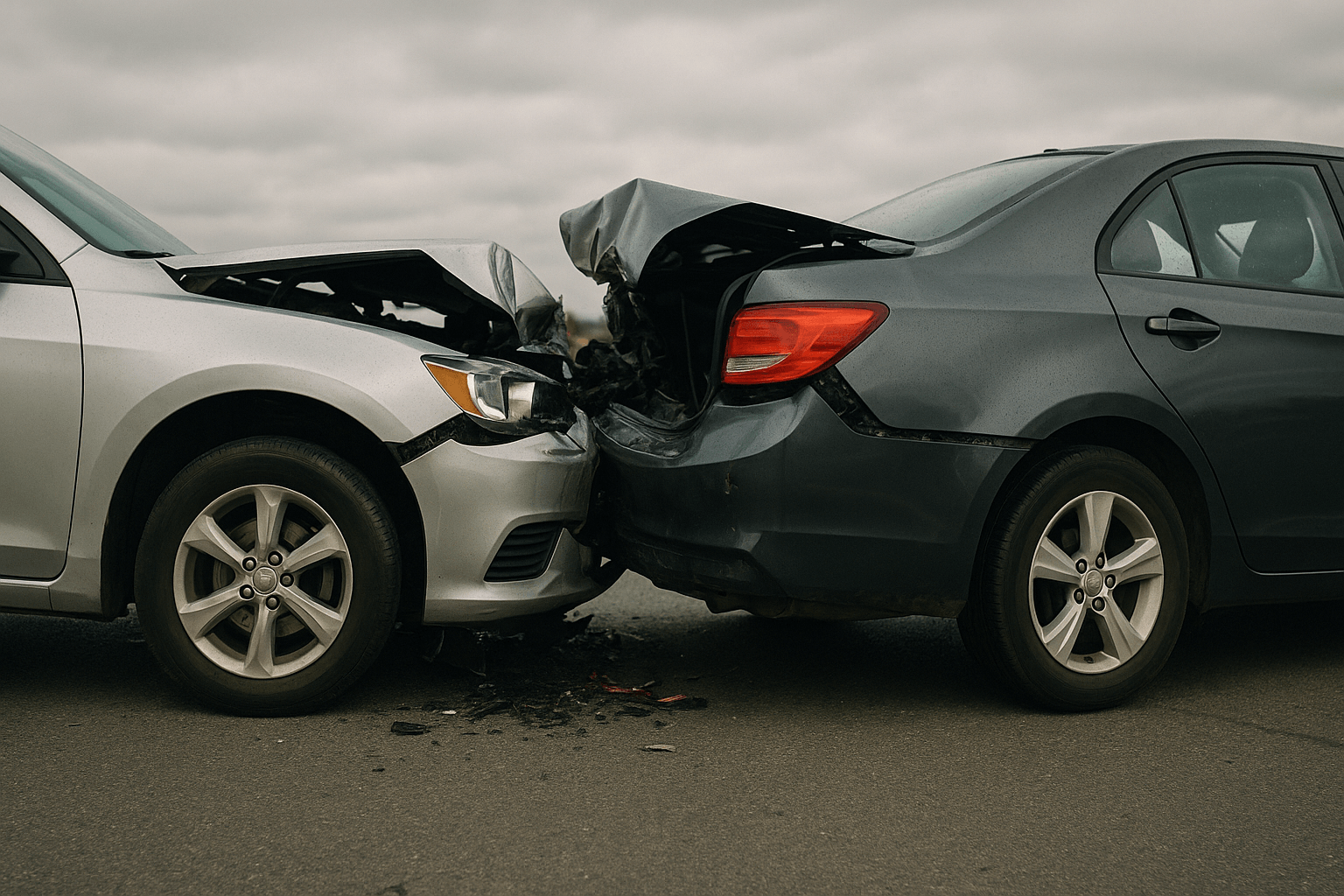

If you were hurt in a car accident anywhere in Ohio and now you can’t work, you’re not alone but you are at risk. Insurance companies are counting on you being too overwhelmed to fight for the full paychecks you deserve. At SELPH LAW, we see this every week: good people sidelined by injuries, losing income while medical bills keep piling up. We make sure you don’t get shortchanged.

This is your straight talk guide to getting paid for lost wages, future income, and protecting your financial security after a crash.

Lost Wages After an Ohio Car Accident What It Really Means

Lost wages are not just the days you called off sick. They can include:

Days you missed for surgery, therapy, or doctor checkups

Overtime you lost because you can’t handle extra hours

Bonuses or commissions you couldn’t earn while recovering

Paid time off or sick leave you burned through to cover missed days

Income you’ll lose if you can’t return to the same job or hours

Insurance companies love to pretend lost wages only mean a couple of missed shifts. Don’t buy it Ohio law says they owe you for every dollar your injury cost you.

What Counts as Proof? (And What Doesn’t)

To get paid, you need more than just your word. You need real backup:

✅ Medical records and doctor’s work restrictions

✅ Pay stubs, W-2s, or tax returns showing what you normally earn

✅ A letter from your employer verifying exactly how much work you missed

✅ Expert opinions if you can’t go back to your old job at the same pay

We see people lose thousands because they didn’t get this early. We handle it for you so you don’t have to scramble.

Self-Employed? Gig Worker? Read This.

Rideshare drivers, contractors, freelancers we see you. And yes: your lost income counts too.

We prove your lost earnings with:

Recent invoices or 1099s

Bank deposits before and after the accident

Contracts you couldn’t fulfill because of your injury

Expert projections of lost revenue for small business owners

Insurance adjusters love to downplay gig income. We don’t let them.

How Future Lost Income Works in Ohio Injury Claims

Some injuries take you off the job for weeks. Others mean you can’t ever do the same work again. That’s when a smart injury claim includes loss of future earning capacity and this is where real money comes in.

At SELPH LAW, we work with:

Medical experts to document permanent limitations

Vocational experts to explain why you can’t do your old job

Economic experts to calculate what your lost future income is worth often hundreds of thousands over a lifetime

These damages don’t just happen automatically. We fight for every dime.

Why Waiting Hurts Your Case

Here’s what insurance companies hope: that you delay getting a doctor’s note, miss paperwork deadlines, or settle your claim too early before you know the full impact on your job. Once you sign, it’s over.

Every day you wait makes it easier for them to argue you weren’t really hurt or that your missed work was your fault. Don’t risk it.

How SELPH LAW Protects Your Paycheck and Your Future

When you hire us, we:

✔️ Handle all insurance calls so you don’t slip up

✔️ Collect bulletproof lost wage proof from your doctor & employer

✔️ Hire the right experts for permanent injury and future income claims

✔️ Fight for a full settlement that covers more than just your medical bills

And you pay nothing up front. We only get paid when we win.

Ready to Get Your Paychecks Back? Let’s Talk.

If your car accident has left you unable to work for days, months, or forever don’t guess what your claim is worth. Let us get you every dollar you legally deserve.

📞 Call SELPH LAW now at (614)-453-0971 for a free, honest review.📍 6047 Frantz Road, Dublin, OH 43017🔗 SELPHLAW.COM

Let’s make sure you don’t pay twice for an accident that wasn’t your fault.